Small and midsize companies are more likely to employ finance directors than CFOs. In small businesses, the finance director oversees all the financial operations and reports to the business owner. They have similar responsibilities to those of a CFO, but they are generally not part of the top executive team. Those in this position typically oversee an organization’s financial operations and report to the CFO. The role of chief financial officer is steadily increasing in importance, and is often second only to that of the CEO. There’s greater emphasis on strategic decision making, rather than simple accounting tasks, and a new focus on environmental, social and governance functions.

Chief Risk Officer

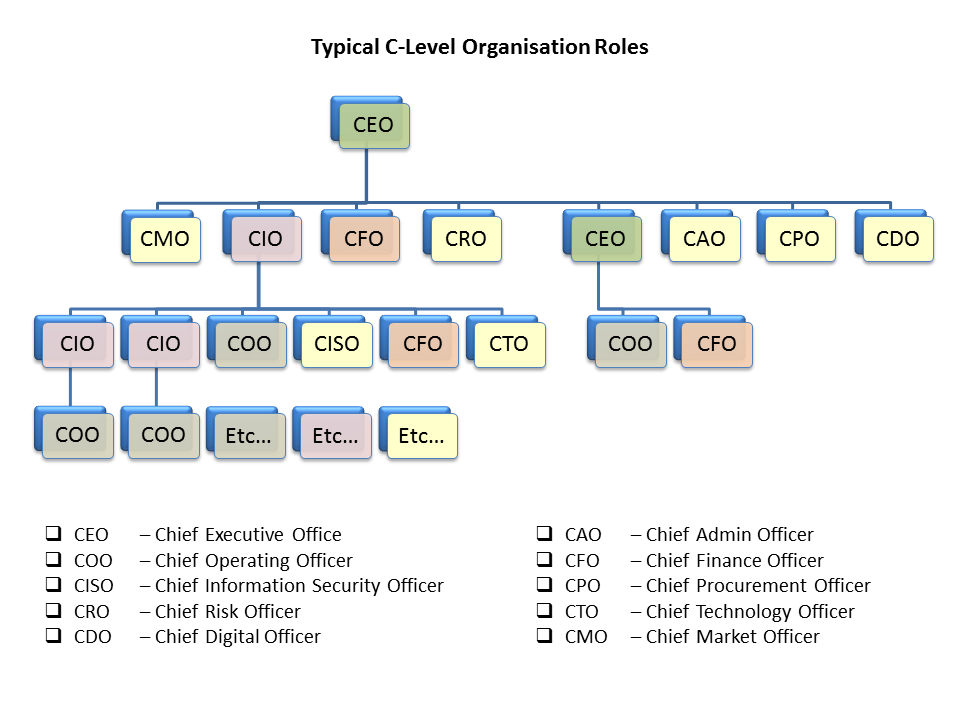

- A CEO (Chief Executive Officer) is the highest top-level executive position within a for-profit organization.

- The CFO is the face of the company’s perceived sustainability to customers, vendors, stakeholders and bankers.

- Top finance executives must have a deep understanding of business and be able to work with all an organization’s departments.

- The CFO will provide financial advice to the CEO and board on, for instance, potential mergers and acquisitions, budgeting and obtaining debt and equity financing.

- CFOs should form an independent, fact-based view of the resources, support structures, and activities that the organization has in place to create value—as well as which ones actually do create value.

Being a CFO is difficult but with education and experience, individuals in the role thrive. CFOs need discipline, initiative, dedication, and time-management skills as well. My least favorite example comes from my first CFO role when we were ready to raise a second round of VC financing. Although we had lined up strategic partners to fund 125% of the entire round, I could not convince the board to bypass bringing in another VC to lead the round. This led to a delay in decision-making and brought us into the beginning of a recession in the industry, where 2 out of our 3 strategic partners backed out of the round. This led to another delay and eventually to only funding 50% of the planned round.

Financial controllers

The CFO will provide financial advice to the CEO and board on, for instance, potential mergers and acquisitions, budgeting and obtaining debt and equity financing. The position of CFO is one of the most senior roles within a business, and, as you’d expect, requires a high level of education and experience. Here’s a look at what the job involves, and how to work your way up to the role.

Federal government of the United States

Over the years, the job has evolved, with an Accenture survey in 2022 revealing that 93% of CFOs agree that the responsibilities they’re now entrusted with feel much greater than in the past. CFOs are now expected to be commercially minded strategic thinkers who can react to changes and influence decision-making across the organization. At the same time, if you are only listening with a financial ear, you don’t have the empathy to understand the culture issues at the company, so your decisions or advice will ring hollow. Today I am the CFO of LeTip International Inc., the world’s largest privately-owned professional business networking organization. LeTip has over 200 local chapters nationwide with thousands of members of small business owners and entrepreneurs in virtually every business industry.

Chief Security Officer

The CFO holds the highest leadership position within a company’s finance division. CFO responsibilities include coordinating the finance department’s activities and working closely with leaders from other departments to achieve the company’s financial objectives. While CFOs often report to the CEO and board of directors, they have much greater autonomy than lower-ranking finance professionals within the company.

This may be more difficult than it seems as leaders’ conclusions can be clouded by incomplete information and biases. Experience as a controller can lead to becoming a CFO or finance cfo title meaning director, but the controller career path doesn’t always lead to a CFO position. Controllers must have a strong set of business and leadership skills to make the leap to CFO.

Most climb the corporate ladder by gaining professional experience in various positions within a company’s financial structure. You’ll need fantastic communication and decision-making abilities and demonstrated leadership, management, and problem-solving skills to succeed in a CFO job. Education requirements for professionals in this role typically include bachelor’s and master’s degrees with specializations in business management or accounting. If you want to gain the advanced knowledge needed to succeed as a CFO, consider pursuing a Master of Business Administration degree.

I jumped at the opportunity, and while I initially was encouraged to take the operations manager job with the new company, as we started working with VCs to get funding, I ended up taking the CFO role. After I received my MBA from Indiana University, I chose to go to work for Intel. I had interned there the prior summer and found the environment very exciting. It was fast-paced and everyone expected the best effort from their teammates. It was a very collaborative environment, especially because the finance department played a business partnership role with other departments.