You may not need a CFO if your business model is simple—with few stock-keeping units and no manufacturing or trade issues—and your leadership team has the information and performance management insights they need to run the business. Your CFO could provide strategic financial planning, ensuring the most efficient use of available funds. They could help budget, forecast future financial needs, and identify areas for cost reduction or investment. They won’t just oversee the company’s finances—they play a part in a broader spectrum of strategic leadership and decision-making. The full compensation package for a chief financial officer depends on a variety of factors, including but not limited to the candidate’s experience and geographic location.

Develop HR management skills

- According to the BLS, the main employers of chief executives in 2020 were private companies and enterprises, local governments, and computer system and design companies.

- Peter says a certified public accountant (CPA) and or MBA is typically necessary in the US to be CFO of a company with IPO aspirations.

- A Chief Financial Officer (CFO) is a senior executive responsible for managing the financial actions of their company.

Your CFO could implement robust cash flow management strategies to ensure your business maintains a healthy liquidity position to meet its operational needs and investment plans. A CFO will be the most senior finance professional responsible for the financial cfo title meaning health of your business. But they tend to wear many hats in medium-sized companies—and even many large ones. CFOs are often at the forefront of innovation in financial management, using technology and data analytics to gain insights and improve efficiency.

How Can I Start a Career That Ends in the C-Suite?

Today’s CFOs are trusted advisors to the CEO and partners to other business leaders. They work closely with — and often serve as the crucial intermediary between — the C-suite, the back office and front-line business units. Given its seniority, the role of chief financial officer is a generally very well-paid one.

Key Takeaways

Learn how you can move from a ‘historian’ to a ‘visionary’ within your business. According to salary.com, midrange US CFO salaries were between $438,800 and $563,000 in 2024. But for a scaling company, hiring a CFO is a critical investment to help get them to the next level. But they also need broad business knowledge and a talent for analytics and performance management to support a results-oriented culture. “Investors typically want a CFO to bring transparency to the company’s performance,” says Peter.

Chief Marketing Officer (CMO)

This should come as no surprise to employers; after all, Gen Z has grown up in the golden age of technology. This bias for action could yield some big changes, even to core business functions. An effective CFO should make sure that every aspect of the business is always on the negotiating table—and should always be subject to a “grow or go” mentality. The best CFOs understand and communicate that it’s a losing bet not to take any risks. The CFO must also play the role of diplomat with third parties; they’re required to continually vouch for the company’s financial viability. The CFO is the face of the company’s perceived sustainability to customers, vendors, stakeholders and bankers.

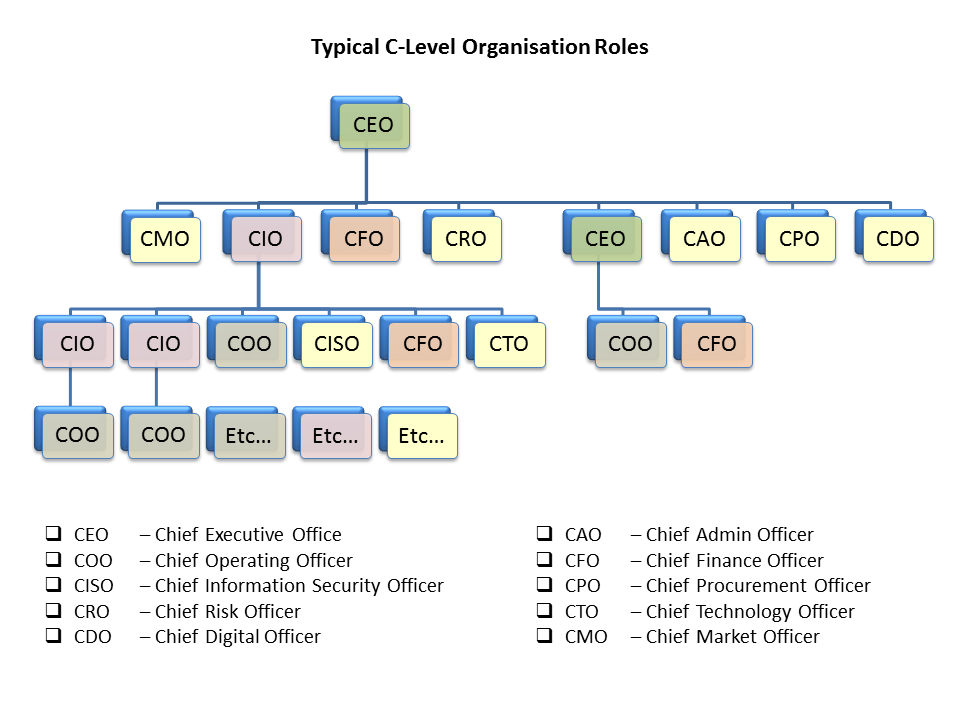

CIO (Chief Information Officer)

The role can be a steppingstone to a higher corporate position, such as president, chairperson or CEO. You can start from almost any angle to get to this position, but you need to have a mind that is curious and an ego that is tamed. My family and my experience at Intel had the biggest impact on my career to becoming a CFO.

As people who develop and guide the financial direction of a company or organization, CFOs have knowledge of accounting, economics, and finance. CFOs have likely worked in one or several areas within finance earlier in their career. The majority of people who end up in this position have advanced degrees and certifications, such as a graduate degree in finance or economics, and the Chartered Financial Analyst (CFA) designation. It also helps to have a background in accounting, investment banking, or analysis. The C-suite is considered a company’s most important and influential group of individuals. Getting there usually requires significant experience and leadership skills.

The customizable, ready-to-use metrics, dashboards, and reports give business leaders real-time insight into their organization’s financial health. Having these insights available in real time gives CFOs the ability to react quickly to market shifts, pursue new business models, or engage in mergers and acquisitions. This C-suite role oversees the work of finance directors and controllers who manage and guide the everyday activities of accounting and finance employees. CFOs with the right balance of experience, education, people skills, strategic planning capabilities, drive and integrity typically are candidates for top corporate jobs. They frequently compete with chief operating officers (COOs) and chief strategy officers (CSOs) for the top position.

The first thing my dad did was relocate the management team’s office from a city 20 miles away from the mill to the same complex as the mill. My dad walked the factory floor every day meeting with people, talking to them, getting to know their lives and jobs. He went from the VP of accounting to the CEO of the steel mill, and ended up growing the company from one U.S. plant to three U.S. plants and three South American plants. The impact of being in a smaller business was alluring in comparison to being one of 3,000 financial team members in a multibillion-dollar worldwide company. Businesses in California employed nearly 34,000 top executives as of May 2021, with annual mean wages approaching $231,000. Top executives in Illinois earned higher mean wages of over $244,000 but only 8,500 positions were available in the state in May 2021.

The uneven pace of recovery worldwide has made it more challenging for many companies. These officers usually start as business analysts and then work toward C-level glory while developing technical skills in disciplines such as programming, coding, project management, and mapping. CIOs are usually skilled at applying these functional skills to risk management, business strategy, and finance activities.